Should I Rent or Should I Buy???!!

This is the age-old question, and it’s a big one! In my profession, I naturally speak with many people about this very question, and quite frankly there is never a straightforward answer! I have advised and helped clients to buy a home, but I have also advised clients NOT to buy a home too.

Deciding between buying and renting a home is a decision that ultimately depends on personal circumstances, financial goals, and lifestyle preferences. This blog is designed to explore the benefits of each option, and to help guide you towards an informed decision, should you be contemplating this very question.

The Benefits of Buying a Home

- Equity & Appreciation

Perhaps the most obvious advantage of buying a home is the opportunity to build equity over time. As you make mortgage payments, you gradually increase your ownership stake in the property. Over the years, this can lead to long-term financial stability and security. So much so, that 83% of personal wealth comes from Home Equity at retirement.

Additionally, property values tend to increase. This market appreciation allows you to generate even greater wealth through home ownership. Property values have increased in 73 of the last 81 years, which shows buying a home is potentially a very solid investment. - Personalization & Stability

We all know the saying “There’s no place like home” and there’s a reason why. Owning a home provides you with the freedom to personalize and customize your living space according to your preferences. Whether it’s painting the walls, remodeling the kitchen, or creating a beautiful garden, homeownership allows you to make your house a true reflection of your personality.

Moreover, owning a home often brings a sense of stability and belonging, as you establish roots in a community and have the potential for long-term residency. - Tax Advantages & Savings Benefits

Renters typically look at their monthly rent v a monthly mortgage on a property and initially see a lower monthly outlay for renting. On the surface this may typically be true, but when yu take a deeper look, there are benefits to buying.

Homeownership comes with potential tax advantages, such as deducting mortgage interest and property taxes from your taxable income. These deductions can help lower your overall tax burden.

Additionally, the act of paying a mortgage can be seen as a form of forced savings, gradually increasing your net worth, as we already discussed.

Lastly, your mortgage does not change. With rising rental costs, a stable mortgage payment could allow you to enjoy more affordable living in the long run.

The Benefits of Renting

- Flexibility

Renting typically offers a level of flexibility that is unmatched by homeownership. If your circumstances change, such as a job relocation or a desire to explore a new neighborhood or city, renting allows you to easily pack up and move. This flexibility can be particularly advantageous for individuals who value variety or have uncertain future plans.

(With resources such as AirBnB, owning a home does now allow for flexibility to some extent too. This can even create a revenue stream to fund a more flexible lifestyle.) - Lower Upfront Costs

One of the immediate benefits of renting is the lower upfront costs compared to buying a home. There is no need for a substantial down payment or the associated expenses of homeownership, such as property taxes, maintenance, and insurance. By renting, you can potentially invest the money you save elsewhere, such as in stocks, education, or other financial goals. This financial flexibility can be especially beneficial for those who prefer to diversify their investments or have shorter-term financial plans. - Less Responsibility for Maintenance

One of the significant advantages of renting is the reduced responsibility for maintenance and repairs. When you rent a home, the landlord or property management company is typically responsible for major repairs and upkeep. This can save you both time and money, as you won’t have to worry about unexpected expenses or the hassle of managing repairs on your own.

Making a Decision

The right decision is ultimately dependent on your personal circumstances. When considering the above benefits of buying or renting, apply these to yourself, and evaluate against your …

- Financial Considerations

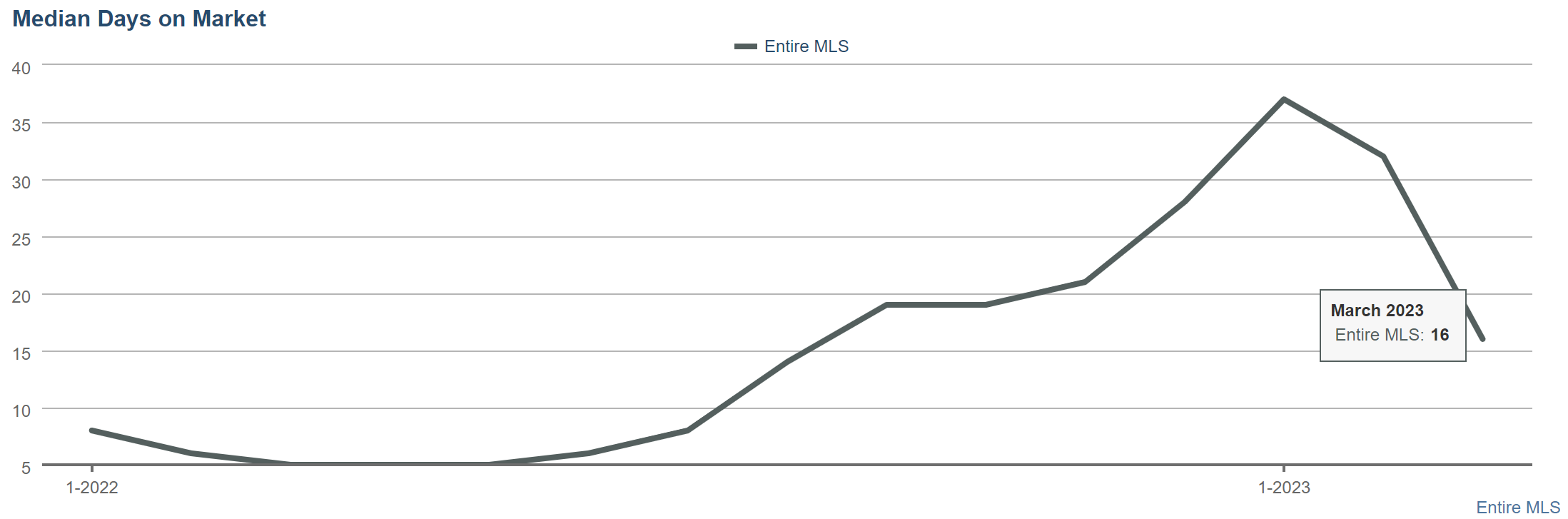

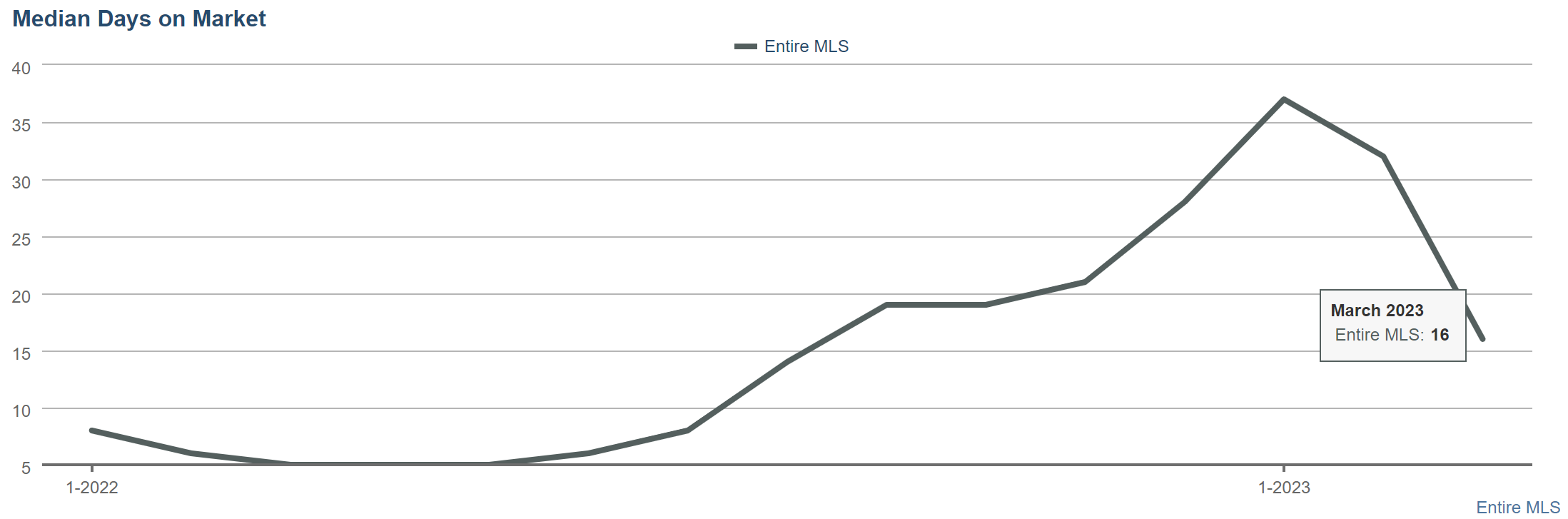

When deciding whether to buy or rent a home, it is crucial to assess your financial situation. Consider factors such as your income, savings, and debt. Reflect on your long-term financial goals and stability. Additionally, take into account prevailing interest rates and market conditions, as they can impact the affordability of homeownership. - Lifestyle and Future Plans

Your desired lifestyle and future plans play a significant role in the housing decision. Evaluate factors such as job security, family plans, and personal preferences. If you value flexibility, frequent travel, or the ability to explore different living environments, renting may be a better fit. On the other hand, if you seek stability, personalization, and a sense of ownership, buying.

Hopefully this will help guide you to an informed decision that is right for you. However, if you would like to discuss this question further, and need help to evaluate what is best for you, I would be happy to offer a honest and free consultation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

.

.