2023 unfolded unexpectedly, deviating from many predictions. Following a sharp surge in interest rates by the end of 2022, the real estate market experienced a near standstill. Contrary to initial projections of a temporary increase, interest rates remained consistently high throughout 2023, challenging both buyers and sellers.

2023 unfolded unexpectedly, deviating from many predictions. Following a sharp surge in interest rates by the end of 2022, the real estate market experienced a near standstill. Contrary to initial projections of a temporary increase, interest rates remained consistently high throughout 2023, challenging both buyers and sellers.

Buyers found themselves either priced out or adopting a wait-and-see approach, hoping for a decline in interest rates or even a crash in home values.

Sellers, reluctant to lose their historically low mortgage rates, hesitated, resulting in decreased inventory.

Surprisingly, despite reduced activity, 2023 still saw a somewhat competitive market, with the decline in active buyers being off-set by the reduction of homes on the market.

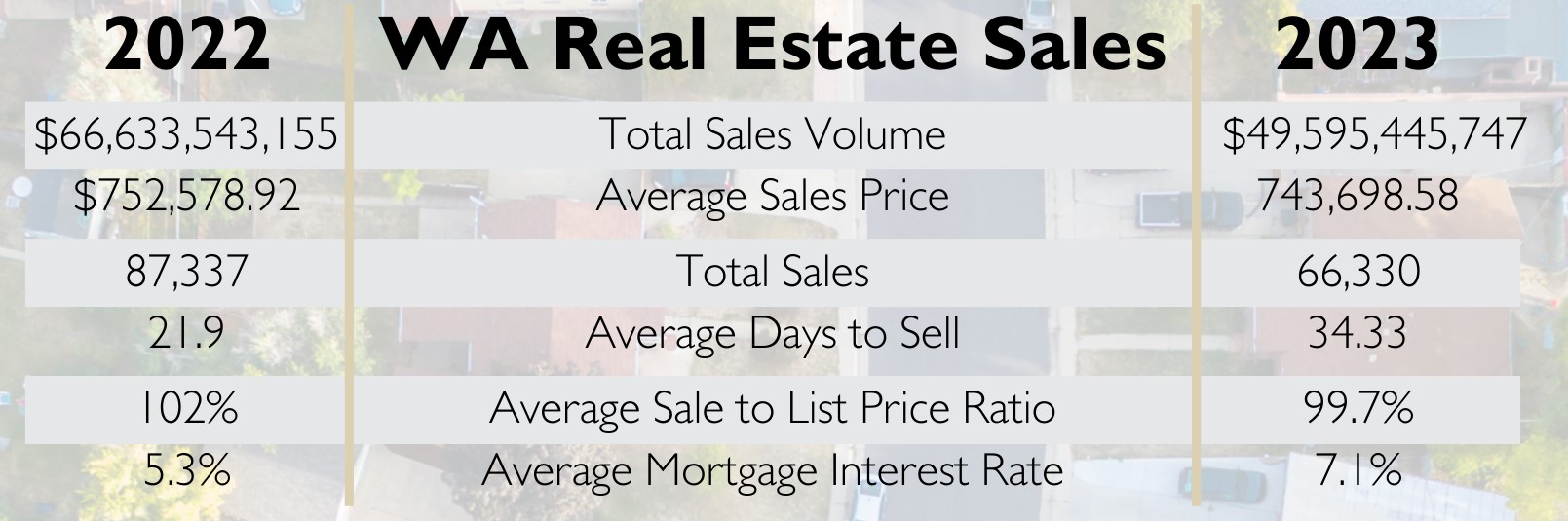

2023 Sales Data

The data shows a significant drop in sales volume. We saw a roughly 25% ($17 billion!!) decrease in total sales volume in WA state in 2023 compared to 2022.

Despite this, the average sales price only dipped by 1%, with homes still selling close to 100% of the list price. This underscores the market’s competitiveness.

Buyers’ Perspective:

There is no denying it, buyers faced challenges in 2023! With persistent high interest rates and limited housing options, the market remained relatively competitive, and the costs of buying had ultimately increased.

The price crash that many had hoped for didn’t occur!

There were still positive aspects for buyers in 2023, even though we did not see a dramatic fall in house prices. When working with my clients, it was important we focused on the following advantages we had:

- Seller Concessions & negotiations.

The ability to have closing costs covered by the sellers, or even have the interest rates bought down, making the mortgage payments affordable, and home ownership attainable. - More time for consideration.

Homes on average stayed on the market for longer, meaning buyers generally were able to make a more considered and educated purchase. - Protective Contingencies.

Buyers were able to protect themselves and the purchase with contingencies in the contract, such as an inspection contingency. By being in a position where they did not have to waive an inspection or financing, buyers were more confident and reassured about their investment. - Getting Ahead of the market & Gaining Equity.

With many many other potential buyers out of the market, active buyers were better positioned to be successful with an offer. As and when interest levels do drop, the market activity will increase significantly. This will drive up prices again. By taking the opportunity to buy in 2023, my clients will benefit from increased home equity, and will be able to refinance to a much lower interest rate too, when the interest rates do fall.

Sellers’ Experience:

For sellers, the decision to sell in 2023 was difficult due to the reluctance to lose low-interest rates. Those who entered the market often faced a longer selling period but dealt with serious, committed buyers. While multiple offers were less frequent, sellers could achieve their target sales price, navigating negotiations on closing costs or interest rate assistance.

Outlook for 2024:

Lower Interest Rates?

The end of 2023 witnessed a significant drop in interest rates, dropping from 8% in October, to circa 6.5% at the turn of the year.

It is widely predicted and anticipated that interest rates will continue to fall in 2024, with the Federal Reserve indicating that there could be 3 cuts to the federal interest rate in 2024.

Predictions indicate rates falling below 6% in 2024, potentially reaching 5% by the year’s end.

Increased Market Activity?

With declining interest rates, increased market activity is anticipated. Buyers will be coming back into the market with increased affordability, and Sellers will also be enticed back into the market again, especially if house prices increase based on buyer activity.

Continued Home Value Appreciation:?

If the economy remains stable and continues to grow, it’s likely that the Washington State real estate market will see continued price appreciation. High demand and limited housing inventory have been contributing factors to home values across the region increasing year-on-year, with appreciation in WA consistently above the national average of 4%.

More Subdivision?

Notable bills passed in 2023, such as E2SHB 1110 and EHB 1337, which aim to address the housing shortage by allowing subdivisions and the construction of Additional Dwelling Units (ADUs).

Both bills provide significant opportunity for homeowners, investors, builders and developers, as the state looks for ways to address the housing shortage. Read more about the bills here:

https://mrsc.org/stay-informed/mrsc-insight/july-2023/major-changes-to-washington-housing-laws

Clearer Representation?

In 2024, revisions to the Buyer Agency Agreement by NWMLS aim to clarify the compensation agreement and expectations for agents. Significantly, as a buyer, a Real Estate Agent now MUST have you sign an Agency Agreement prior to representing you in any transaction. This ensures that buyers are being represented with full clarity, and that essential conversations are had, and important questions are addressed, at the very start of the agent/client relationship.

Personal Highlights:

On a professional level, 2023 proved to be a successful year. I managed to match the total sales volume that I produced in 2022, which I am particularly proud of, considering the industry saw a 25% reduction year-on-year. These sales were the result of forming great relationships with some wonderful people, and helping people achieve their dreams. This is the real win of working in real estate and why I will continue to do what I do, not matter how challenging the market may come.

But, by far the greatest moment of 2023, was becoming a father, and welcoming my son Eton Cross into the world.

He has changed my world.

Whatever your plans, goals & dreams for next year are … Eton and I wish you a very happy & prosperous 2024!!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link